MINNESOTA DIVESTMENT COALITION – February 2022 Briefing to the SBI

1. Recommended due diligence procedures for private equity investment decisions.

Almost 25% of SBI holdings are in private equity companies such as KKR and Blackrock. Investments in private equity industries differ in a very important way from investments in publicly traded companies – once the investment has been made and the contract signed, there is no latitude for engagement and proxy voting. While private equity investments tend to offer higher returns, they carry higher risk and do not permit stakeholders to engage with them on ESG issues once the investments are made. This argues for much greater scrutiny upfront.

The Minnesota Divestment Coalition recommends that the SBI not make any further investments in private equity companies unless they are able to meet the criteria below (taken from the October 2021 Report from the Private Equity Stakeholder Project, https://pestakeholder.org/report/climate-crisis/).

“To date the private equity industry has not adequately addressed its role in propelling climate change which underscores the importance of engagement by stakeholders to press the industry to pivot away from fossil fuels. Institutional investors whose capital is at risk must demand that their private market partners use their capital responsibly through investing in adherence to a 1.5 degree future. Investors should insist that the private equity managers:

1. Develop and disclose a plan with clear incremental benchmarks to shift energy portfolios to be pollution free.

2. Commit to no expansion of fossil fuel or operations, in alignment with the IEA (International Energy Agency) Net-Zero 2050 roadmap.

3. Provide a risk management strategy under a 1.5 degree scenario consistent with science-based emission targets as well as scenarios above 1.5 degrees.

4. Disclose all direct and indirect emissions as well as other climate impacts such as spills, accidents, environmental fines.

5. Provide transparency on political spending and how it aligns with the UN’s PRI (Principles for Responsible Investment) Investor Expectations on Corporate

Climate Lobbying including:

- Corporate and executive political spending – lobbying and campaign contributions

- Political spending by portfolio companies and their executives

- Membership in trade associations and how these trade associations’ lobbying positions align with the goals of the Paris Agreement.”

The SBI should take swift action to put such a procedure in place – especially because private equity contracts span multiple years and investments cannot be withdrawn. This argues for much greater scrutiny upfront, especially at a time when Minnesota is working to achieve net-zero goals.

2. Additional SBI staffing required for robust corporate engagement

The MN Divestment Coalition strongly favors divestment over engagement. However, if the SBI Board wants the SBI staff to continue its engagement activities to address ESG concerns, then we recommend that staffing dedicated to engagement be significantly increased. As SBI staff can attest, engagement is a very time-intensive activity. While its impact can be much greater than proxy voting, it requires a lot of staff time. The SBI portfolio has expanded significantly over the last decade; however, the staffing levels have remained largely unchanged. In an environment where Minnesota citizens are demanding that their pension investments support their ESG values, the SBI needs to significantly increase ESG staffing in order to undertake a robust engagement program. In the past, the SBI has regularly returned operating funds to the state. These funds could be better utilized by adding additional staff to focus on engagement.

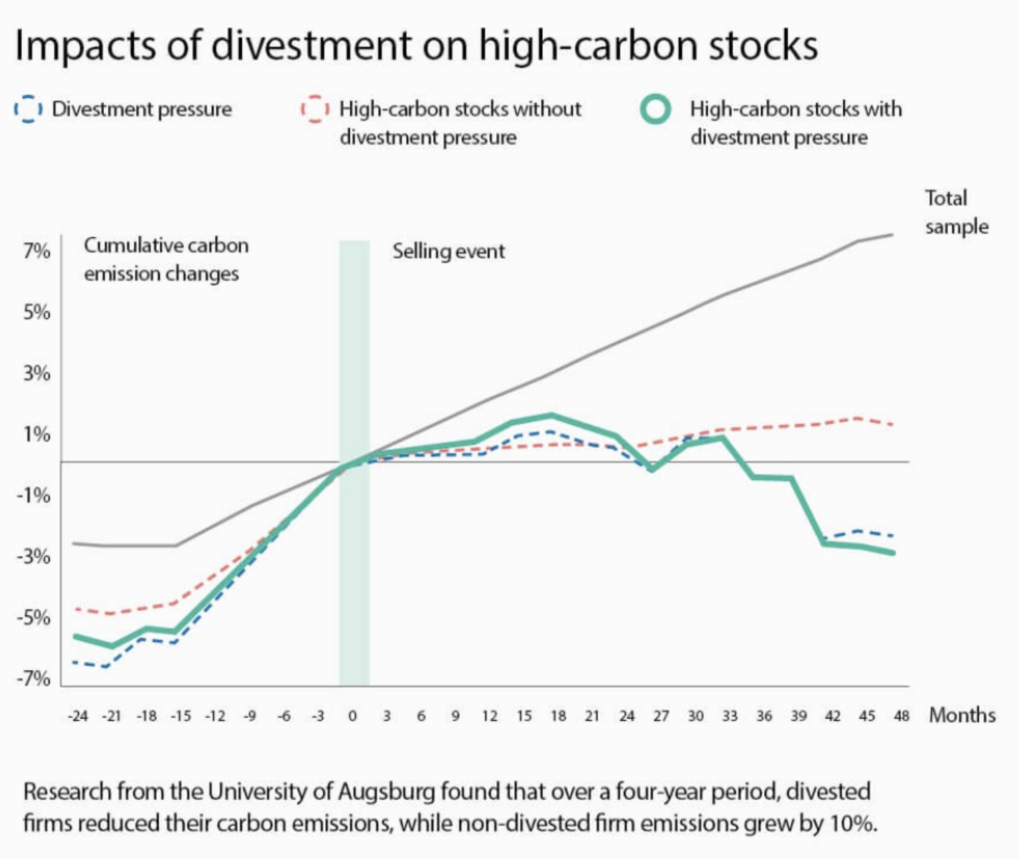

3. New evidence that divestment reduces GHG emissions

“This fall, research out of the University of Augsburg in Germany has concluded that divestment isn’t just chipping away at the fossil fuel sector’s social capital. “Divestment can lead to more sustainability in the real economy,” said Martin Rohleder, the university’s chair of finance and banking, calling it “the first empirical evidence on the impact of divestment.”

The researchers found that divestment by equity funds can “exert sufficient selling pressure to cause the stock prices of climate-damaging stocks to fall in the long run,” said Rohleder.

Over a four-year period, the divested firms reduced their carbon emissions, while emissions from non-divested firms grew by 10%. Their conclusion: “Overall, our findings support the divestment movement’s hope that a critical mass of investors is able to reduce carbon emissions.”1

[1] https://www.corporateknights.com/responsible-investing/divestment-study/ by Rick Spense